New GST Invoice Management System: Streamlining ITC and Invoice Corrections

Introduction:

Starting from October 1st, a groundbreaking feature is coming to the GST portal: the Invoice Management System (IMS). This new functionality aims to simplify the way taxpayers manage invoice corrections and amendments, enhancing the accuracy and efficiency of Input Tax Credit (ITC) claims. Here’s a detailed look at how the IMS will revolutionize the GST ecosystem.

What is the Invoice Management System (IMS)?

The Invoice Management System (IMS) is a new tool developed by GST Network (GSTN) to help taxpayers handle invoices more effectively. With IMS, taxpayers can review, accept, reject, or keep invoices pending directly through the GST portal. This process ensures that only verified invoices are included in GSTR-2B, aiding in the accurate claiming of ITC.

Key Features of IMS:

- Invoice Actions:

- Accept: Approved invoices will be included in the GSTR-2B as part of the eligible ITC.

- Reject: Rejected invoices will be excluded from the GSTR-2B, thereby not affecting the ITC.

- Pending: Invoices can be kept pending for future review and action. They will not be part of the GSTR-2B until a decision is made.

- Timeline for Actions:

- Recipients can take actions on invoices from the moment they are saved in GSTR-1/IFF/1A until the filing of their corresponding GSTR-3B. If no action is taken, invoices will be deemed accepted and included in GSTR-2B.

- Handling Amendments:

- If a supplier amends an invoice before GSTR-1 is filed, the updated invoice will replace the original in IMS. If amended through GSTR-1A, it will reflect in the IMS and impact the ITC for the subsequent month.

- ITC Computation and GSTR-2B:

- GSTR-2B will only include filed invoices/records. A draft GSTR-2B will be available by the 14th of the subsequent month. Taxpayers can still modify their invoice actions after this date but must recompute GSTR-2B before filing GSTR-3B.

- Record Categories:

- No Action: Deemed accepted and included in GSTR-2B.

- Accepted: Included in GSTR-2B as eligible ITC.

- Rejected: Not included in GSTR-2B.

- Pending: Carried forward in IMS for future action.

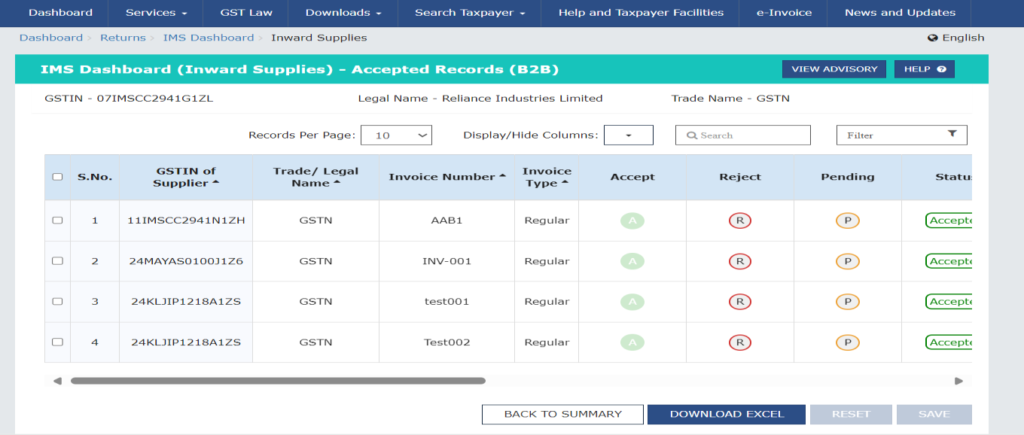

A sample screenshot of the IMS dashboard:

Special Considerations for QRMP Taxpayers:

Quarterly Return Monthly Payment (QRMP) taxpayers will have their invoices filed through IFF flow into IMS. GSTR-2B will be generated quarterly for QRMP taxpayers, not monthly, with GSTR-2B for months M-1 and M-2 being skipped.

How IMS Enhances Taxpayer Experience:

- Streamlined Process: The IMS simplifies the invoice management process, reducing the burden of manual reconciliation.

- Accuracy in ITC Claims: By allowing taxpayers to review and take action on invoices, IMS ensures only valid ITC claims are processed.

- Reduced Compliance Burden: Invoices with no action taken will be automatically deemed accepted, minimizing the need for manual intervention.

Key Points to Remember:

- Recompute GSTR-2B: It is mandatory to recompute GSTR-2B for any changes in invoice status or actions taken after the 14th of the month.

- Action on Original Records: Ensure that actions are taken on original records and GSTR-3B is filed before addressing any amendments.

- Sequential GSTR-2B: GSTR-2B for a return period will only be generated if GSTR-3B for the previous period is filed.

Conclusion:

The introduction of the Invoice Management System (IMS) marks a significant advancement in the GST compliance landscape. By facilitating accurate ITC claims and streamlining invoice corrections, IMS will enhance operational efficiency for taxpayers. Stay updated and make the most of this new feature to ensure seamless GST compliance and accurate ITC management.

For more updates on GST and tax compliance, keep following our blog!

A copy of the Advisory Issued by the department can be downloaded here.